Yellow phosphorus market rebound remains uncertain

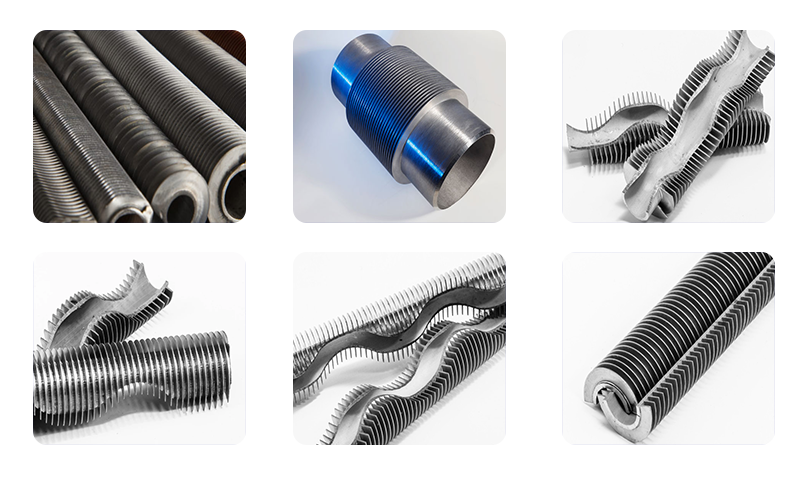

Non Standard Custom Finned Tube

Divided according to the fin structure characteristics: according to the shape and structure of the fin shape, finned tubes can be divided into the following categories, square finned tubes, spiral finned tubes, longitudinal finned tubes, etc., spiral serrated finned tubes, inner finned tubes Tube. Because the suit process is simple, the skill requirements are not high, the equipment used is cheap, and it is easy to maintain, so it is still used by many factories until now.

Our company has accumulated many years of experience in high-frequency welding finned tubes, square finned tubes, inlaid finned tubes, and rolling composite steel and aluminum finned tubes.

Laser welded spiral finned tubes are used in civil wall-hung boilers, industrial boilers, etc., using German technology, which has a history of more than ten years in Europe. The advantage is that the contact thermal resistance is zero, and compared with high-frequency welding Light, small thermal resistance, high penetration rate, and the assembled heat exchanger has the characteristics of compact size, more energy saving and environmental protection, and meets the national emission requirements

Non standard customization,Finned tube with small weld,Environmentally friendly finned tube Wuxi Mcway Equipment Technology Co., LTD , https://www.mcwayfinnedtube.com

The market has been sluggish for many years because of yellow phosphorus is one of the key monitoring products of the country's energy-saving emission reduction. After the market price of yellow phosphorus broke the historical record of 20,000 yuan for a short period of time in early 2004, it began to decline. In recent years, it has fallen into the downturn of 10,000 yuan, which has triggered an overall huge loss for the industry for more than two years in a row, forcing half of the enterprises to shut down and stop production. The yellow phosphorus industry The operating rate is less than 50%.

The fundamental reason for the downturn in the yellow phosphorus industry is overcapacity and cost pressures. It is reported that China's yellow phosphorus production capacity is close to 1.6 million tons/year, accounting for 68% of the world's total production capacity, but the market demand is only 800,000 tons/year. As yellow phosphorus is a non-renewable resource, the state has continuously introduced measures in recent years, including adding 20% ​​of export tariffs, etc., in order to curb its disorderly and low-cost exports, which also limits the use of some of its production capacity. The factory cost of one ton of yellow phosphorus is about 11,000 yuan, but for more than two consecutive years, the ex-factory price is within 10,500 yuan. In addition to companies with private power plants such as Nanyang Group and Yunnan Pingbian Yellow Phosphorus Plant, and the financial status of a small number of companies with small hydropower advantages may be unexpectedly strong, the rest will not be able to escape losses. This year's overall loss of yellow phosphorus industry is a foregone conclusion.

There are three reasons for the improvement of the market. Since late October, the market price of yellow phosphorus has been rising. This has brought a bit of warmth to the long-chilled market. This is mainly due to three factors.

The first is the "year-end effect." Downstream users generally have traditional practices for storing raw materials in winter. This mainly considers seasonal reasons: a winter yellow phosphorus production area is facing a dry season, which will limit the production of yellow phosphorus enterprises that use some hydropower; second, it will be difficult to purchase due to factors such as heavy snowfall affecting the transportation and spring transportation. Obviously, a large number of users' recent centralized purchases have pushed up prices.

The second is policy stimulus. Due to the recent introduction of New Deal in major yellow phosphorus production areas, stimulated the yellow phosphorus prices higher. For example, Yunnan issued the Opinions on Promoting the Structural Adjustment of the Yellow Phosphorus Industry, which clearly stipulates that 35 production lines for 5,000 tons of yellow phosphorus should be phased out before the end of 2007, and 8 more will be closed in the first half of next year. In addition, the industry’s strong appeal for raising the threshold and elimination of outdated medium and small yellow phosphorus devices have undoubtedly pushed up the expectations of higher yellow phosphorus prices, strengthened the inertial thinking that the market does not buy or fall, and contributed to the rapid rise in yellow phosphorus prices.

The third is oversold bounce. The law of the market has also played a role. Continuous loss-making operations have caused the financial pressure of production companies to rise sharply and there is an inherent driving force for price increases. As with the stock market, there will be a rebound if it falls more.

The market outlook is still difficult to be optimistic Although this wave of price rebound has occurred, this should not be too optimistic, because neither the production sector nor the consumption sector has shown any signs that the yellow phosphorus industry has been booming. Except for the root cause of serious overcapacity in the industry, its structural contradictions have not yet been improved. Statistics show that there are more than 130 yellow phosphorus production enterprises in China, mainly in areas with phosphate deposits such as Yun, Gui, Chuan, and Hubei. Relatively speaking, most of the devices are relatively backward, and the scale is small. There are defects of high consumption and high pollution. There are less than 40 backbone enterprises with a production capacity of over 10,000 tons. The industry believes that the current industry threshold is too low, as long as there is phosphate rock, invest a few million dollars to a yellow phosphorus furnace. These are not conducive to industrial restructuring and optimization, limiting the healthy development of the industry.

At the same time, the ability of downstream phosphates and pesticides to digest price increases is not optimistic. Phosphate products are greatly affected by the export tax rebate policy. The major phosphorus-consuming products, sodium tripolyphosphate and phosphoric acid, will no longer enjoy 13% export tax rebates and cost pressure will be huge. The current price of yellow phosphorus has exceeded 15,000 yuan, soda is as high as 1,700 yuan, and white coal has exceeded 900 yuan. This has caused the production of phosphate to be in a loss situation. It is already a profit-making or non-profitable product and is simply unable to withstand the significant price increase of yellow phosphorus. In addition, due to the growing demand for "phosphorus ban" in society, industrial sodium tripolyphosphate is gradually abandoned by the detergent industry, and its largest use is gradually being lost, which is accompanied by a sharp drop in phosphorus consumption.

The reporter communicated with many people in the industry and found that their expectations for this yellow phosphorus price rebound were not too high. There is a view that the rapid increase in the price of yellow phosphorus apparently has a “sheep†effect. Buying momentum is obviously increasing, but when the ex-factory price reaches 14,000 yuan, it should tend to ease or even fall back. Currently, some of the yellow phosphorus is stored in the hands of middlemen, and it is estimated that they will seek out high points before and after New Year's Day; at the same time, the rapid and rapid price increase will also cause idle production capacity to start, and it will also stimulate higher production costs in Sichuan and Hubei. The resumption of the company's business, these factors will increase the market supply, inhibit the continued rise in yellow phosphorus prices.

At the same time, the industry is also generally worried that with the recent increase in the price of yellow phosphorus, the product has been profitable, in some areas will slow down the pace of eliminating backward production capacity, and even ease the monitoring of energy-saving emission reduction efforts will be exhausted . Just think, if nearly half of the production capacity is revived in the near future, what will happen to the yellow phosphorus market?